Home > Releases > Weekly Treasury Inflation-Indexed Securities > 10-Year 2% Treasury Inflation-Indexed Note, Due 1/15/2016 (DISCONTINUED)

2016-01-15: -0.26 |

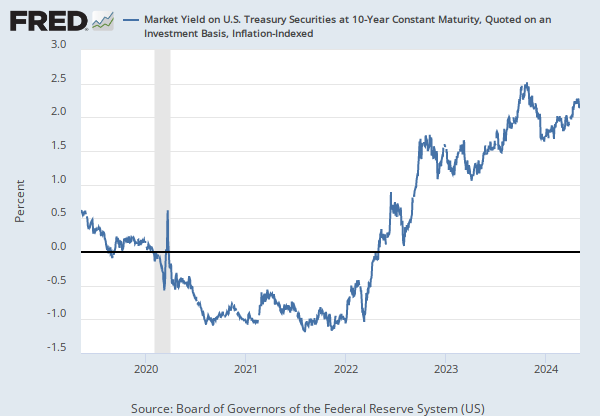

Percent |

Weekly,

Ending Friday | Updated: Jan 19, 2016 7:36 AM CST

Ending Friday | Updated: Jan 19, 2016 7:36 AM CST

Observation:

2016-01-15: -0.26 (+ more) Updated: Jan 19, 2016 7:36 AM CST| 2016-01-15: | -0.26 | |

| 2016-01-08: | 2.39 | |

| 2016-01-01: | 1.39 | |

| 2015-12-25: | 1.84 | |

| 2015-12-18: | 1.87 |

Units:

Percent,Not Seasonally Adjusted

Frequency:

Weekly,Ending Friday