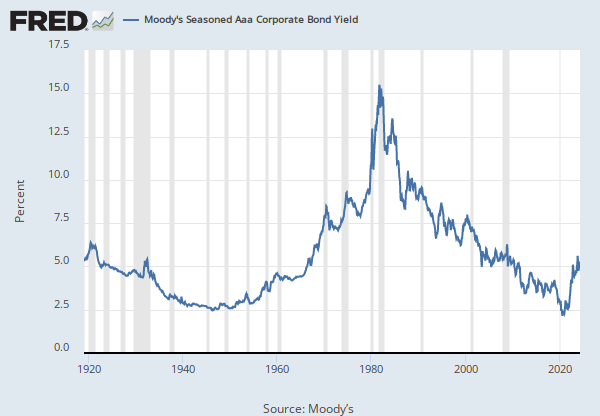

Home > Releases > Corporate Bond Yield Curve > 10-Year High Quality Market (HQM) Corporate Bond Spot Rate

Nov 2024: 5.15 |

Percent |

Monthly |

Updated:

Dec 6, 2024

2:03 PM CST

Observation:

Nov 2024: 5.15 (+ more) Updated: Dec 6, 2024 2:03 PM CST| Nov 2024: | 5.15 | |

| Oct 2024: | 4.91 | |

| Sep 2024: | 4.63 | |

| Aug 2024: | 4.82 | |

| Jul 2024: | 5.14 |

Units:

Percent,Not Seasonally Adjusted

Frequency:

Monthly